Pros and Cons of ICOs and IEOs

- Understanding ICOs and IEOs

- The Rise of Initial Coin Offerings (ICOs)

- Exploring the Benefits of ICOs

- The Drawbacks of Initial Exchange Offerings (IEOs)

- Comparing ICOs and IEOs: Which is Better?

- Regulatory Challenges Faced by ICOs and IEOs

Understanding ICOs and IEOs

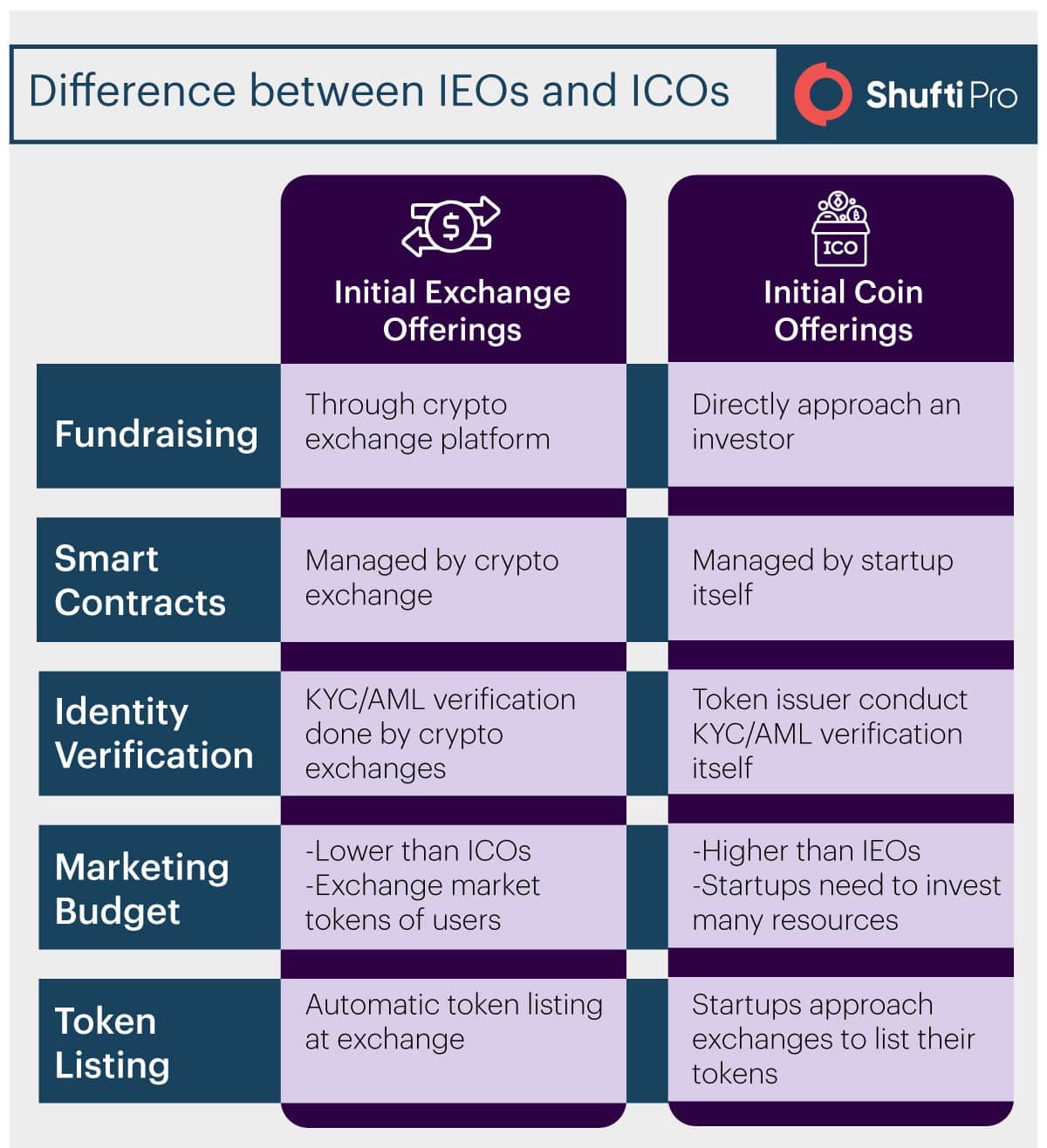

When it comes to understanding Initial Coin Offerings (ICOs) and Initial Exchange Offerings (IEOs), it is essential to grasp the key differences between the two fundraising methods. ICOs involve a company creating a new digital currency and selling it to investors in exchange for established cryptocurrencies like Bitcoin or Ethereum. On the other hand, IEOs are similar to ICOs, but the tokens are sold through a cryptocurrency exchange platform that acts as an intermediary.

One of the main advantages of ICOs is that they allow startups to raise capital quickly and efficiently without the need for traditional financial institutions. However, this lack of regulation can also be a double-edged sword, as it opens the door to potential scams and fraudulent activities. In contrast, IEOs offer a higher level of security and credibility since the exchange platform vets the projects before listing them.

Investors looking to participate in ICOs or IEOs should conduct thorough research on the project, team, and market conditions before making any investment decisions. It is crucial to understand the risks involved, such as market volatility, regulatory uncertainty, and the potential for project failure. By staying informed and cautious, investors can navigate the world of ICOs and IEOs more effectively and make informed investment choices.

The Rise of Initial Coin Offerings (ICOs)

Initial Coin Offerings (ICOs) have experienced a significant rise in popularity in recent years. This fundraising method involves companies issuing digital tokens to investors in exchange for capital. ICOs have become a preferred choice for many startups looking to raise funds quickly and efficiently.

One of the main advantages of ICOs is that they provide access to a global pool of investors, allowing companies to reach a larger audience than traditional fundraising methods. Additionally, ICOs offer a more streamlined process compared to traditional venture capital funding, as they do not require extensive paperwork or intermediaries.

However, the rise of ICOs has also brought about some challenges. The lack of regulation in the industry has led to a proliferation of scams and fraudulent activities. Investors are often at risk of losing their funds due to the lack of oversight and accountability in the ICO space.

Despite these challenges, ICOs continue to be a popular choice for companies seeking to raise capital quickly and efficiently. As the industry continues to evolve, it is essential for investors to conduct thorough due diligence before participating in any ICO to mitigate the risks associated with this fundraising method.

Exploring the Benefits of ICOs

Exploring the benefits of Initial Coin Offerings (ICOs) can provide valuable insights into why this fundraising method has gained popularity in the cryptocurrency space. One of the main advantages of ICOs is the potential for high returns on investment. Investors have the opportunity to purchase tokens at a low price during the ICO phase and sell them at a higher price once the project gains traction. This can result in significant profits for early backers.

Another benefit of ICOs is the accessibility they offer to a wide range of investors. Unlike traditional fundraising methods, which are often limited to accredited investors, ICOs allow anyone with an internet connection to participate. This democratization of investment opportunities has helped to level the playing field and open up new avenues for capital formation.

Furthermore, ICOs provide a way for blockchain projects to raise funds quickly and efficiently. By issuing tokens on a decentralized platform, companies can bypass the lengthy and costly process of traditional fundraising. This streamlined approach not only saves time and money but also allows projects to focus on development rather than fundraising.

The Drawbacks of Initial Exchange Offerings (IEOs)

While Initial Exchange Offerings (IEOs) have their advantages, there are also drawbacks to consider before participating in one. It is important to weigh the pros and cons carefully to make an informed decision.

- 1. **Lack of Regulation:** One of the main drawbacks of IEOs is the lack of regulation compared to traditional investment methods. This can lead to a higher risk of scams and fraudulent activities.

- 2. **Limited Accessibility:** IEOs are often limited to users of specific cryptocurrency exchanges, which can restrict access for potential investors who are not registered on those platforms.

- 3. **Centralization:** IEOs are typically conducted on centralized exchanges, which goes against the decentralized nature of blockchain technology. This centralization can lead to issues such as censorship and control by a single entity.

- 4. **Higher Costs:** Participating in an IEO may involve higher costs compared to Initial Coin Offerings (ICOs), as exchanges usually charge listing fees and other expenses.

- 5. **Limited Transparency:** Due to the centralized nature of IEOs, there may be limited transparency in the fundraising process, making it difficult for investors to verify the legitimacy of the project.

Overall, while IEOs offer certain benefits such as increased security and credibility, it is essential to be aware of the drawbacks and potential risks involved. Conducting thorough research and due diligence before participating in an IEO can help mitigate these risks and make a more informed investment decision.

Comparing ICOs and IEOs: Which is Better?

When it comes to comparing ICOs and IEOs, it is essential to consider the advantages and disadvantages of each fundraising method. ICOs, or Initial Coin Offerings, have been around for longer and have gained popularity due to their decentralized nature. On the other hand, IEOs, or Initial Exchange Offerings, are conducted through cryptocurrency exchanges, providing a sense of security and credibility to investors.

One of the main differences between ICOs and IEOs is the level of risk involved. ICOs are known for their lack of regulation, making them susceptible to scams and fraudulent activities. In contrast, IEOs are vetted by exchanges, reducing the risk of potential scams and ensuring a higher level of investor protection.

Another factor to consider when comparing ICOs and IEOs is the level of exposure and marketing opportunities. ICOs allow projects to reach a broader audience through various marketing channels, while IEOs benefit from the established user base of cryptocurrency exchanges, providing instant access to potential investors.

Ultimately, the decision between ICOs and IEOs depends on the specific needs and goals of the project. While ICOs offer more flexibility and freedom, IEOs provide a higher level of security and credibility. It is essential for project teams to weigh the pros and cons of each fundraising method carefully before making a decision.

Regulatory Challenges Faced by ICOs and IEOs

One of the major challenges faced by Initial Coin Offerings (ICOs) and Initial Exchange Offerings (IEOs) is navigating the complex regulatory landscape. Governments around the world have varying degrees of regulations when it comes to cryptocurrencies and token sales, making it difficult for ICOs and IEOs to operate legally in different jurisdictions.

Regulatory uncertainty can lead to legal issues, fines, or even shutdowns for ICOs and IEOs that fail to comply with the rules. This can create a barrier to entry for new projects looking to raise funds through token sales, as they must carefully consider the legal implications of their offerings.

Additionally, regulatory challenges can also impact the reputation of ICOs and IEOs in the eyes of investors. Projects that are seen as operating in a legal gray area may struggle to attract funding, as investors may be wary of potential legal repercussions.

Overall, navigating the regulatory challenges faced by ICOs and IEOs is crucial for the long-term success and sustainability of these fundraising methods. By staying informed about the latest regulations and working to comply with them, projects can increase their chances of success and build trust with investors.