Crypto Market Cycles: Bull and Bear Trends

- Understanding the Crypto Market Cycles

- Exploring the Dynamics of Bull Trends in Crypto

- Navigating the Volatility of Bear Trends in the Crypto Market

- Analyzing the Factors Influencing Bull and Bear Trends

- Strategies for Profiting in Bull and Bear Markets

- The Psychological Impact of Crypto Market Cycles

Understanding the Crypto Market Cycles

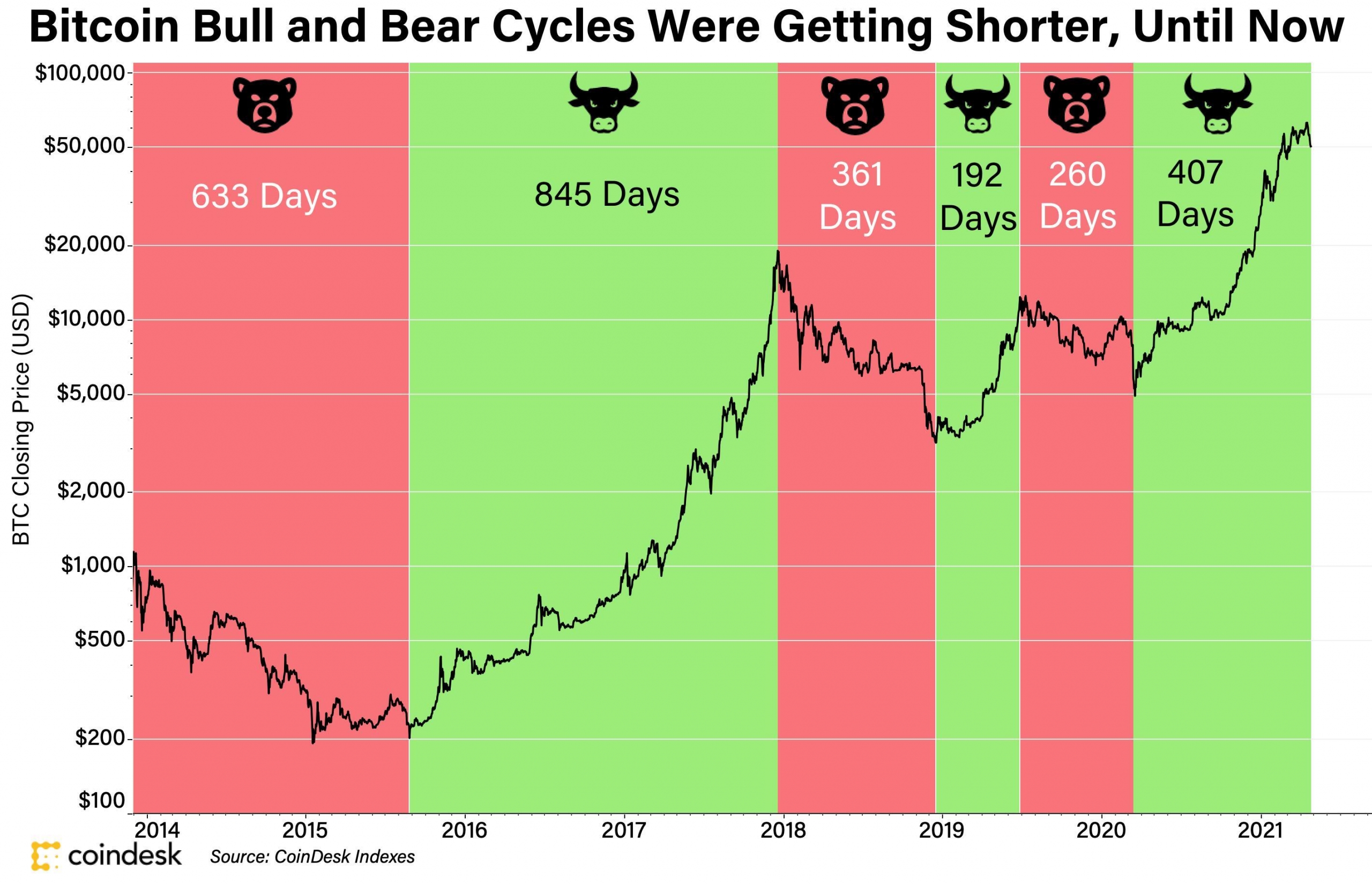

The crypto market cycles are characterized by alternating periods of bull and bear trends. Understanding these cycles is crucial for crypto investors to make informed decisions and maximize their profits. Bull trends are characterized by rising prices, increased trading volume, and overall market optimism. On the other hand, bear trends are marked by falling prices, decreased trading volume, and pessimism among investors.

During a bull trend, crypto assets tend to experience rapid price appreciation, attracting new investors and driving up demand. This is often fueled by positive news, technological advancements, or market speculation. As prices continue to rise, more investors jump on the bandwagon, further driving up prices in a self-reinforcing cycle.

Conversely, during a bear trend, crypto assets experience price declines, leading to a decrease in investor confidence and overall market sentiment. This can be triggered by negative news, regulatory crackdowns, or market manipulation. As prices fall, investors may panic sell, exacerbating the downward trend.

It is important for crypto investors to recognize these market cycles and adjust their investment strategies accordingly. During a bull trend, it may be wise to take profits and secure gains, while during a bear trend, it may be an opportunity to buy assets at a discount. By understanding and navigating these cycles, crypto investors can position themselves for long-term success in the volatile crypto market.

Exploring the Dynamics of Bull Trends in Crypto

Exploring the dynamics of bull trends in the crypto market can provide valuable insights into understanding the cyclical nature of digital assets. Bull trends are characterized by sustained periods of price increases, investor optimism, and overall market growth. These trends often coincide with increased trading volumes and positive sentiment among market participants.

During bull trends, cryptocurrencies experience significant upward momentum, leading to new all-time highs and attracting new investors looking to capitalize on the potential for high returns. As prices continue to rise, FOMO (fear of missing out) can drive further demand, fueling the bullish momentum even more.

It is essential for investors to recognize the signs of a bull trend and differentiate it from a temporary price spike. By conducting thorough research, analyzing market data, and monitoring key indicators, investors can make informed decisions to capitalize on the opportunities presented by bull trends in the crypto market.

Navigating the Volatility of Bear Trends in the Crypto Market

Navigating the volatility of **bear trends** in the **crypto market** can be a challenging task for **investors**. During these periods, **prices** tend to **decline** sharply, causing **uncertainty** and **fear** among **traders**. It is crucial to have a **solid** **risk management** strategy in place to **protect** your **investments** during **bear markets**.

One **strategy** to **navigate** **bear trends** is to **diversify** your **portfolio**. By **investing** in a **variety** of **cryptocurrencies**, you can **spread** your **risk** and **minimize** the impact of **price** **volatility** on your **overall** **investment**. **Diversification** can help **protect** your **portfolio** from **large** **losses** in any **single** **asset**.

Another **important** **factor** to consider when **navigating** **bear markets** is to **stay** **informed** about **market** **trends** and **news**. **Keeping** up with the latest **developments** in the **crypto** **industry** can help you make **informed** **decisions** about when to **buy** or **sell** **assets**. **Utilizing** **technical** **analysis** and **fundamental** **research** can also **help** you **identify** **opportunities** in the **market**.

It is **crucial** to **remain** **patient** during **bear markets** and **avoid** making **impulsive** **decisions** based on **emotions**. **Market** **cycles** are **inevitable** in the **crypto** **industry**, and **prices** will **eventually** **recover** from **bear trends**. **Sticking** to your **investment** **strategy** and **maintaining** a **long-term** **perspective** can **help** you **weather** the **volatility** of **bear markets** and **emerge** **stronger** in the **long** **run**.

Analyzing the Factors Influencing Bull and Bear Trends

Analyzing the factors influencing bull and bear trends in the crypto market is crucial for investors looking to make informed decisions. Several key elements play a role in determining whether the market is experiencing a bull or bear trend.

One significant factor influencing market trends is market sentiment. **Investors**’ emotions and perceptions about the market can drive prices up during a bull trend or down during a bear trend. **Market sentiment** can be influenced by news, social media, and overall market conditions.

Another factor to consider is market fundamentals. **Market fundamentals** refer to the underlying factors that drive the value of a cryptocurrency, such as technology, adoption, and regulatory developments. Positive **fundamentals** can lead to a bull trend, while negative **fundamentals** can result in a bear trend.

Technical analysis is also essential for understanding market trends. **Technical analysis** involves studying price charts and patterns to predict future price movements. **Technical indicators** can help investors identify potential trend reversals and make informed trading decisions.

External factors, such as macroeconomic trends and geopolitical events, can also impact crypto market cycles. **External factors** like inflation, interest rates, and global economic uncertainty can influence investor behavior and market trends.

Overall, a combination of market sentiment, market fundamentals, technical analysis, and external factors can help investors analyze and understand bull and bear trends in the crypto market. By staying informed and monitoring these key elements, investors can make more strategic investment decisions.

Strategies for Profiting in Bull and Bear Markets

When it comes to navigating the volatile crypto market cycles, having strategies in place for both bull and bear trends is crucial for profiting. Here are some tips to help you make the most of these market fluctuations:

- During bull markets, consider taking profits on your investments as prices rise. It’s important to have an exit strategy in place to lock in gains and protect your capital.

- Look for opportunities to diversify your portfolio during bull markets. This can help spread risk and maximize potential returns across different assets.

- When bear markets hit, consider buying the dip. This strategy involves purchasing assets at lower prices with the expectation that they will rebound in the future.

- Take advantage of short selling opportunities during bear markets. This strategy allows you to profit from price declines by borrowing assets and selling them at a higher price before buying them back at a lower price.

- Stay informed about market trends and developments to make informed decisions during both bull and bear markets. Keeping a close eye on news and analysis can help you stay ahead of the curve.

By implementing these strategies and staying disciplined in your trading approach, you can navigate crypto market cycles with confidence and increase your chances of success in both bull and bear trends.

The Psychological Impact of Crypto Market Cycles

The **psychological impact** of **crypto market cycles** can be significant for investors and traders alike. **Market trends** can evoke a range of emotions, from **euphoria** during **bull markets** to **fear** and **panic** during **bear markets**. This rollercoaster of emotions can lead to **stress**, **anxiety**, and **uncertainty** among participants in the **cryptocurrency market**.

During **bull trends**, investors may experience a sense of **greed** and **FOMO** (fear of missing out), leading them to make **impulsive** decisions based on **irrational exuberance**. This can result in **overtrading**, **overleveraging**, and **taking on excessive risk**. Conversely, **bear trends** can trigger feelings of **despair**, **hopelessness**, and **loss aversion**, causing investors to **sell off** their assets at **low prices** out of **fear** of further **losses**.

It is essential for **crypto market participants** to **manage their emotions** and **maintain a rational mindset** throughout **market cycles**. **Practicing** **patience**, **discipline**, and **risk management** can help **mitigate** the **psychological impact** of **volatile market conditions**. Additionally, seeking **support** from **mentors**, **community**, or **professional counselors** can provide **perspective** and **guidance** during **challenging times** in the **crypto market**.

By **understanding** and **addressing** the **psychological factors** at play in **crypto market cycles**, investors can **make more informed decisions** and **navigate** the **ups and downs** of the **market** with **greater resilience** and **emotional intelligence**. **Developing** a **healthy** **mindset** and **emotional** **well-being** is **crucial** for **long-term success** in the **cryptocurrency** **space**.