Crypto Lending and Borrowing Trends

- The Rise of Crypto Lending Platforms

- Exploring the Benefits of Borrowing with Cryptocurrency

- Analyzing the Growing Popularity of Crypto Loans

- Understanding the Risks Associated with Crypto Borrowing

- Comparing Interest Rates in the Crypto Lending Market

- The Future of Decentralized Finance: Crypto Lending and Borrowing

The Rise of Crypto Lending Platforms

The rise of crypto lending platforms has been a significant trend in the cryptocurrency market in recent years. These platforms allow investors to lend their digital assets to others in exchange for interest payments. This has opened up new opportunities for traders to earn passive income on their crypto holdings.

One of the key advantages of crypto lending platforms is that they provide liquidity to investors who may not want to sell their cryptocurrencies but still need access to cash. By lending out their digital assets, investors can earn interest while retaining ownership of their crypto holdings.

Moreover, crypto lending platforms have also become popular among traders who use leverage to margin trade cryptocurrencies. By borrowing digital assets from other investors, traders can increase their trading positions and potentially amplify their profits.

Exploring the Benefits of Borrowing with Cryptocurrency

Exploring the benefits of borrowing with cryptocurrency can provide individuals with a new way to access funds without going through traditional financial institutions. One of the main advantages of borrowing with cryptocurrency is the ability to secure a loan quickly and easily, without the need for a credit check or lengthy approval process. This can be especially beneficial for individuals who may not have a strong credit history or who need funds urgently.

Another benefit of borrowing with cryptocurrency is the potential for lower interest rates compared to traditional loans. Because cryptocurrency loans are often peer-to-peer, borrowers may be able to negotiate more favorable terms with lenders, resulting in cost savings over time. Additionally, borrowing with cryptocurrency can provide individuals with more flexibility in terms of loan terms and repayment options, allowing them to tailor the loan to their specific needs.

Furthermore, borrowing with cryptocurrency can also offer individuals a level of privacy and security that may not be available with traditional loans. Cryptocurrency transactions are typically encrypted and decentralized, meaning that borrowers can maintain a level of anonymity when accessing funds. This can be particularly appealing for individuals who value their privacy and want to keep their financial transactions confidential.

Analyzing the Growing Popularity of Crypto Loans

The popularity of crypto loans has been steadily increasing in recent years as more people are turning to cryptocurrencies as a way to diversify their investment portfolios. This trend can be attributed to the growing acceptance and adoption of digital assets in mainstream finance.

One of the main reasons for the rise in crypto lending is the flexibility and convenience it offers to borrowers. Unlike traditional banks, which have strict lending criteria and lengthy approval processes, crypto lending platforms allow users to borrow funds quickly and easily using their cryptocurrency holdings as collateral.

Another factor driving the popularity of crypto loans is the low interest rates offered by many lending platforms. This has made borrowing against cryptocurrencies an attractive option for individuals looking to access liquidity without having to sell their digital assets.

Furthermore, the decentralized nature of crypto lending platforms provides users with greater control over their funds and eliminates the need for intermediaries, such as banks. This level of autonomy and transparency has resonated with many individuals who are seeking alternatives to traditional financial institutions.

Understanding the Risks Associated with Crypto Borrowing

When considering crypto borrowing, it is crucial to understand the risks associated with this practice. While crypto lending can be a lucrative opportunity for investors, it also comes with its fair share of potential pitfalls.

One of the main risks of crypto borrowing is the volatility of the cryptocurrency market. Prices can fluctuate dramatically in a short period, leading to potential losses for borrowers. It is essential to carefully monitor the market and have a risk management strategy in place to mitigate these fluctuations.

Another risk to consider is the security of the crypto lending platform. With the rise of crypto scams and hacks, it is crucial to choose a reputable platform with robust security measures in place. Conduct thorough research and due diligence before entrusting your cryptocurrency assets to any platform.

Additionally, borrowers should be aware of the terms and conditions of the crypto lending agreement. Some platforms may have hidden fees or stringent repayment terms that could catch borrowers off guard. It is essential to read the fine print and fully understand the terms before proceeding with any crypto borrowing transaction.

In conclusion, while crypto borrowing can be a profitable venture, it is essential to approach it with caution and awareness of the potential risks involved. By staying informed, conducting thorough research, and implementing a sound risk management strategy, borrowers can navigate the crypto lending landscape successfully.

Comparing Interest Rates in the Crypto Lending Market

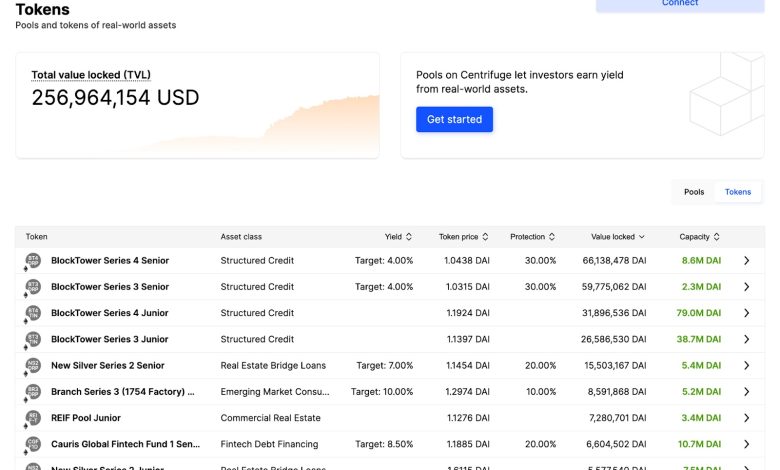

When comparing interest rates in the crypto lending market, it is essential to consider various factors that can impact the rates offered by different platforms. Interest rates can vary significantly depending on the platform, the type of cryptocurrency being lent or borrowed, and market conditions.

Some platforms may offer fixed interest rates, while others may offer variable rates that are tied to market fluctuations. It is crucial to carefully evaluate the terms and conditions of each platform to determine which option best suits your needs. Additionally, consider the reputation and security measures of the platform to ensure that your funds are safe.

It is also important to keep in mind that interest rates in the crypto lending market can change rapidly. Stay informed about market trends and be prepared to adjust your lending or borrowing strategy accordingly. By staying proactive and informed, you can maximize your returns and minimize risks in the crypto lending market.

The Future of Decentralized Finance: Crypto Lending and Borrowing

The future of decentralized finance (DeFi) is looking bright, especially when it comes to crypto lending and borrowing. This sector has been experiencing rapid growth and innovation, with more and more people turning to DeFi platforms for their financial needs. As the traditional banking system continues to face challenges, decentralized lending and borrowing are becoming increasingly popular among individuals and institutions alike.

One of the key advantages of crypto lending and borrowing is the ability to access financial services without the need for a middleman. This not only reduces costs but also provides greater transparency and security for users. With smart contracts and blockchain technology, transactions can be executed quickly and efficiently, without the need for manual intervention.

Furthermore, the rise of decentralized stablecoins has made it easier for users to borrow and lend cryptocurrencies without being exposed to the volatility of the market. Stablecoins are pegged to a stable asset, such as the US dollar, providing users with a more predictable borrowing and lending experience.

Overall, the future of DeFi lending and borrowing looks promising, with more innovations on the horizon. As the sector continues to mature, we can expect to see even greater adoption and integration with traditional financial systems. Whether you are looking to borrow funds or earn interest on your crypto assets, decentralized finance offers a wide range of opportunities for users to explore.