Analyzing Crypto Exchange Volume Data

- Understanding the Importance of Crypto Exchange Volume Data

- Exploring the Factors Influencing Crypto Exchange Volume

- Interpreting Trends in Crypto Exchange Volume Data

- The Role of Liquidity in Crypto Exchange Volume Analysis

- Comparing Exchange Volume Data Across Different Cryptocurrencies

- Strategies for Utilizing Crypto Exchange Volume Data for Trading Purposes

Understanding the Importance of Crypto Exchange Volume Data

Understanding the importance of **crypto exchange volume data** is crucial for **cryptocurrency** traders and investors. **Crypto exchange volume data** provides valuable insights into market trends, **liquidity**, and **price** movements. By analyzing **crypto exchange volume data**, traders can make more informed decisions and **strategies**.

One of the key reasons why **crypto exchange volume data** is important is that it **indicates** the level of **market activity** for a particular **cryptocurrency**. High **exchange volume** often **indicates** increased **interest** and **participation** in a **cryptocurrency**, which can lead to **price** **volatility**. On the other hand, low **exchange volume** may **signal** a lack of **interest** in a **cryptocurrency**, which could result in **stagnant** **price** movements.

Additionally, **crypto exchange volume data** can help **traders** identify **potential** **trading** opportunities. **High** **exchange volume** combined with **price** **movement** can **indicate** **increased** **market** **activity** and **momentum**, which may present **profitable** **trading** **opportunities**. Conversely, **low** **exchange volume** coupled with **price** **stability** may **indicate** a **lack** of **trading** **opportunities**.

Moreover, **analyzing** **crypto exchange volume data** can also help **traders** and investors **detect** **market** **manipulation**. **Abnormally** **high** or **low** **exchange volume** **spikes** may **indicate** **market** **manipulation** or **pump** and **dump** **schemes**. By **monitoring** **exchange volume** **data**, **traders** can **protect** themselves from **falling** **victim** to **such** **activities**.

Exploring the Factors Influencing Crypto Exchange Volume

Cryptocurrency exchange volume is influenced by several factors that can impact trading activity. Understanding these factors can help investors and traders make informed decisions when participating in the crypto market. Some of the key factors influencing crypto exchange volume include:

- Market Sentiment: Market sentiment plays a crucial role in driving trading volume on crypto exchanges. Positive news and developments in the cryptocurrency space can lead to increased trading activity, while negative news can result in a decrease in volume.

- Regulatory Environment: The regulatory environment in different countries can impact crypto exchange volume. Uncertainty or changes in regulations can lead to fluctuations in trading activity as investors may become more cautious.

- Market Liquidity: Liquidity is essential for a healthy trading environment. Higher liquidity often leads to increased trading volume as it allows for easier buying and selling of assets.

- Volatility: Price volatility is a common characteristic of the cryptocurrency market. Higher volatility can attract traders looking to capitalize on price swings, leading to increased trading volume.

- Market Manipulation: Market manipulation can also influence crypto exchange volume. Activities such as wash trading or spoofing can create artificial trading volume, misleading investors and impacting market dynamics.

By considering these factors and monitoring market trends, investors can gain valuable insights into the dynamics of crypto exchange volume. This information can help them make more informed decisions when trading cryptocurrencies and managing their investment portfolios.

Interpreting Trends in Crypto Exchange Volume Data

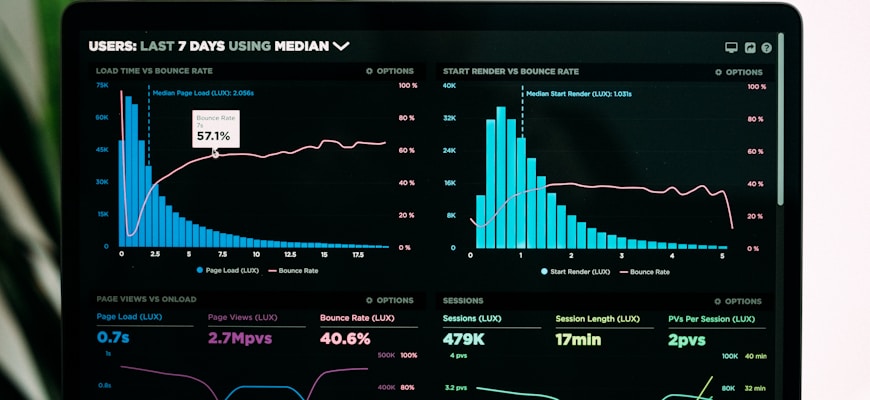

When it comes to interpreting trends in crypto exchange volume data, there are several key factors to consider. One of the most important things to look at is the overall volume trend over a given period of time. Analyzing whether the volume is increasing, decreasing, or staying relatively stable can provide valuable insights into market sentiment and trading activity.

Another important aspect to consider is the relationship between exchange volume and price movements. Oftentimes, there is a direct correlation between volume spikes and significant changes in crypto prices. By identifying these patterns, traders can gain a better understanding of market dynamics and potentially make more informed trading decisions.

It is also essential to analyze the volume distribution across different crypto assets on an exchange. Some assets may have higher trading volumes than others, which can indicate market liquidity and interest levels. By monitoring these volume distributions, traders can identify opportunities for profit and diversification.

The Role of Liquidity in Crypto Exchange Volume Analysis

When analyzing crypto exchange volume data, one important factor to consider is the role of liquidity. Liquidity refers to the ease with which an asset can be bought or sold without causing a significant change in price. In the context of cryptocurrency exchanges, higher liquidity typically leads to higher trading volumes as traders are able to execute larger orders without impacting the market price.

High liquidity is generally seen as a positive attribute for an exchange as it attracts more traders and allows for smoother trading experiences. On the other hand, low liquidity can result in slippage, where the execution price of a trade differs from the expected price. This can lead to increased trading costs and reduced profitability for traders.

By analyzing the liquidity of different trading pairs on a crypto exchange, traders can gain insights into which markets are more actively traded and where opportunities for arbitrage or price speculation may exist. Liquidity analysis can also help identify potential risks, such as market manipulation or flash crashes, that may be more prevalent in less liquid markets.

In conclusion, understanding the role of liquidity in crypto exchange volume analysis is crucial for making informed trading decisions and managing risk effectively. By paying attention to liquidity metrics and trends, traders can better navigate the complex and rapidly evolving world of cryptocurrency trading.

Comparing Exchange Volume Data Across Different Cryptocurrencies

When it comes to analyzing cryptocurrency exchange volume data, comparing the data across different cryptocurrencies can provide valuable insights. By looking at the volume of trades for various cryptocurrencies, investors can gain a better understanding of market trends and investor sentiment.

One way to compare exchange volume data across different cryptocurrencies is to create a table that lists the volume of trades for each cryptocurrency side by side. This allows for easy comparison and visualization of the data. Additionally, using charts and graphs can help to further analyze and interpret the volume data.

It is important to consider factors such as market capitalization, liquidity, and trading pairs when comparing exchange volume data. Cryptocurrencies with higher market capitalization and liquidity are likely to have higher trading volumes. Additionally, cryptocurrencies with a wide range of trading pairs may attract more traders and higher trading volumes.

By comparing exchange volume data across different cryptocurrencies, investors can identify opportunities for trading and investment. Understanding the volume of trades for various cryptocurrencies can help investors make informed decisions and capitalize on market trends. Analyzing exchange volume data is an essential part of cryptocurrency trading and investment strategy.

Strategies for Utilizing Crypto Exchange Volume Data for Trading Purposes

One effective way to gain insights from **crypto** exchange volume data is to utilize various **strategies** for trading purposes. By analyzing **volume** data, traders can make more **informed** decisions and **identify** potential **market** trends. Here are some **strategies** to consider when **utilizing** **crypto** exchange volume data for trading:

- **Volume** analysis: One **strategy** is to **analyze** the **volume** of **trading** activity on a particular **exchange**. By **monitoring** **volume** trends, traders can **determine** the **level** of **interest** in a **particular** **cryptocurrency**.

- **Comparative** **analysis**: Another **effective** **strategy** is to **compare** **volume** data across different **exchanges**. This can **provide** valuable **insights** into **where** the **majority** of **trading** activity is **occurring**.

- **Historical** **analysis**: **Examining** **historical** **volume** data can help **traders** **identify** patterns and **trends** that may **impact** future **price** movements.

- **Correlation** **analysis**: **Looking** at **correlations** between **volume** data and **price** **movements** can help **traders** **predict** **market** **directions** and **make** more **informed** decisions.

- **Risk** **management**: **Using** **volume** data to **manage** **risk** is also **crucial** for **traders**. By **monitoring** **volume** **fluctuations**, **traders** can **adjust** their **strategies** accordingly to **minimize** **losses**.

By **implementing** these **strategies** and **utilizing** **crypto** exchange volume data effectively, **traders** can **gain** a **competitive** edge in the **cryptocurrency** **market** and **improve** their **trading** **performance**.