The Influence of Mining on Crypto Prices

- Understanding the relationship between mining activities and cryptocurrency prices

- How mining operations impact the value of digital assets

- Exploring the correlation between mining difficulty and crypto price fluctuations

- The role of mining in shaping the market dynamics of cryptocurrencies

- Analyzing the effects of mining rewards on the overall crypto market

- The future of crypto prices in relation to the evolving mining landscape

Understanding the relationship between mining activities and cryptocurrency prices

Mining activities play a crucial role in the cryptocurrency market, influencing prices in various ways. Understanding the relationship between mining and crypto prices is essential for investors and enthusiasts alike.

One key factor to consider is the impact of mining on the supply of cryptocurrencies. As miners validate transactions and add new blocks to the blockchain, they are rewarded with newly minted coins. This process increases the circulating supply of the cryptocurrency, which can put downward pressure on prices.

Additionally, mining difficulty can also affect prices. As more miners join the network, the difficulty of solving cryptographic puzzles increases. This can lead to higher costs for miners, which may result in selling pressure as they look to cover their expenses.

On the other hand, mining can also have a positive impact on prices. The security and decentralization provided by a robust mining network can increase investor confidence, leading to higher demand for the cryptocurrency. This increased demand can help support prices, especially during times of market volatility.

Overall, the relationship between mining activities and cryptocurrency prices is complex and multifaceted. By understanding the various factors at play, investors can make more informed decisions and navigate the volatile crypto market more effectively.

How mining operations impact the value of digital assets

One of the key factors that influence the value of digital assets is the impact of mining operations. Mining plays a crucial role in the creation and maintenance of cryptocurrencies, such as Bitcoin and Ethereum. The process of mining involves solving complex mathematical problems to validate transactions and add them to the blockchain. This process requires a significant amount of computational power and energy, which can have a direct impact on the value of digital assets.

When mining operations are profitable, miners are incentivized to continue mining, which can increase the supply of digital assets in the market. This increase in supply can lead to a decrease in the value of the assets, as the market becomes flooded with new coins. On the other hand, when mining operations become less profitable, miners may reduce their activities, leading to a decrease in the supply of digital assets and potentially driving up their value.

Additionally, mining operations can also impact the value of digital assets through the process of mining rewards. Miners are rewarded with newly minted coins for their efforts in validating transactions and securing the network. The rate at which new coins are created through mining can affect the overall supply of digital assets and, consequently, their value in the market.

Exploring the correlation between mining difficulty and crypto price fluctuations

One interesting aspect to consider when examining the relationship between mining difficulty and cryptocurrency price fluctuations is how changes in mining difficulty can impact the overall market sentiment. As mining difficulty increases, it becomes more challenging for miners to validate transactions and earn rewards. This can lead to a decrease in the supply of newly minted coins, which may in turn drive up the price of the cryptocurrency.

Conversely, a decrease in mining difficulty could result in more coins being mined, potentially flooding the market and causing prices to drop. This correlation between mining difficulty and price fluctuations highlights the interconnected nature of the cryptocurrency ecosystem.

It is important for investors and traders to monitor mining difficulty levels as part of their overall market analysis. By understanding how changes in mining difficulty can impact prices, individuals can make more informed decisions about when to buy or sell cryptocurrencies.

The role of mining in shaping the market dynamics of cryptocurrencies

Mining plays a crucial role in shaping the market dynamics of cryptocurrencies. The process of mining involves solving complex mathematical problems to validate transactions on the blockchain network. Miners are rewarded with newly minted coins for their efforts, which helps in increasing the circulation of cryptocurrencies in the market.

One of the key ways in which mining influences crypto prices is through the supply and demand dynamics. As more miners participate in the network, the supply of new coins increases, which can lead to downward pressure on prices. Conversely, when mining activity decreases, the supply of new coins decreases, leading to potential price appreciation.

Additionally, mining also impacts the security and stability of a cryptocurrency network. The more miners participate in the network, the more secure it becomes against potential attacks. This increased security can lead to greater investor confidence in the cryptocurrency, which can positively impact prices.

Furthermore, mining can also affect the decentralization of a cryptocurrency. If a small number of miners control the majority of the network’s hash rate, it can lead to centralization issues, which can impact the overall health of the cryptocurrency ecosystem. This, in turn, can influence investor sentiment and prices.

Analyzing the effects of mining rewards on the overall crypto market

Mining rewards play a significant role in the overall dynamics of the cryptocurrency market. The issuance of new coins through mining directly impacts the supply of a particular cryptocurrency, which in turn affects its price. Understanding how mining rewards influence the market can provide valuable insights for investors and traders.

When miners receive rewards for validating transactions and securing the network, they are essentially introducing new coins into circulation. This increase in the supply of the cryptocurrency can lead to downward pressure on prices, as the market becomes flooded with more coins. Conversely, a decrease in mining rewards can result in a reduction in the supply of the cryptocurrency, potentially driving prices higher.

It is essential to consider the impact of mining rewards on the overall market when analyzing the price movements of cryptocurrencies. By monitoring changes in mining rewards and their effect on supply, investors can better anticipate potential price fluctuations and make more informed trading decisions. Additionally, understanding the relationship between mining rewards and market prices can help identify trends and patterns that may influence future price movements.

The future of crypto prices in relation to the evolving mining landscape

As the mining landscape for cryptocurrencies continues to evolve, it is essential to consider how this will impact the future prices of digital assets. The process of mining plays a crucial role in the overall supply and demand dynamics of cryptocurrencies, which in turn influences their market value.

One key factor to consider is the increasing difficulty of mining, which is driven by the competition among miners to validate transactions and secure the network. As more miners participate in the process, the computational power required to mine new coins also increases. This can lead to a decrease in the rate at which new coins are generated, ultimately affecting the overall supply of the cryptocurrency.

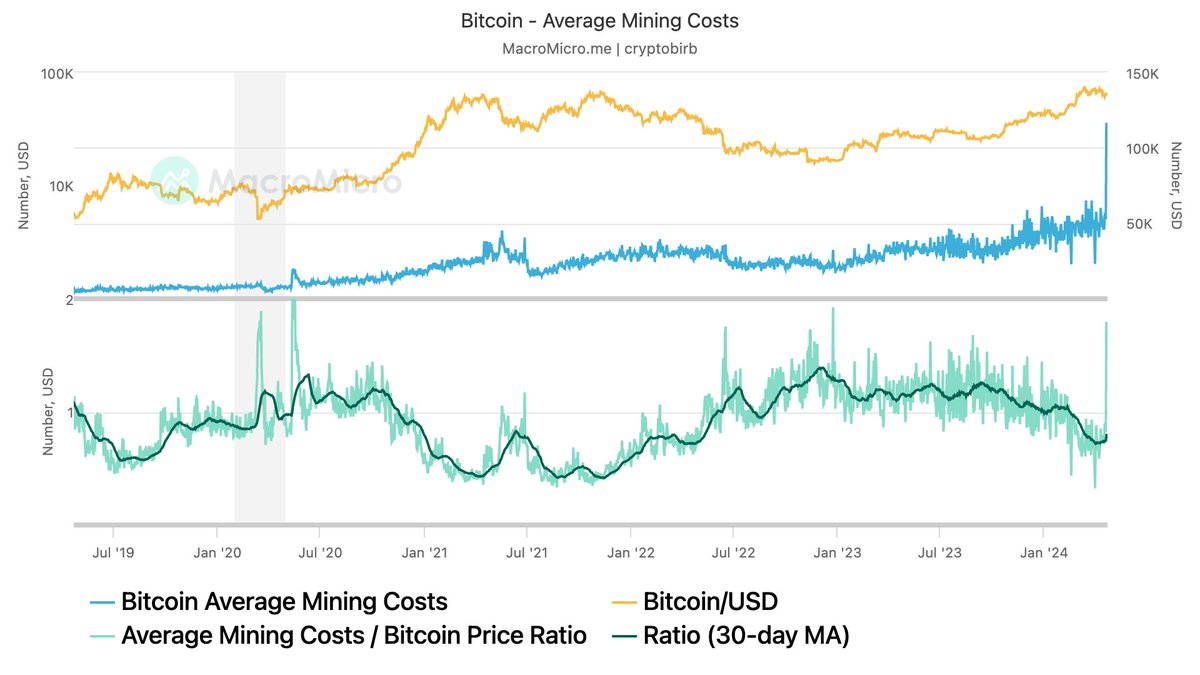

Another important aspect to take into account is the cost of mining. As the complexity of mining operations grows, so does the energy consumption and hardware requirements. Miners need to invest in powerful equipment and bear the costs of electricity to remain competitive in the market. This cost factor can have a direct impact on the profitability of mining operations and, consequently, on the supply of new coins.

Furthermore, the halving events that occur in certain cryptocurrencies, such as Bitcoin, can also influence their prices. These events reduce the rewards given to miners for validating transactions, effectively decreasing the rate at which new coins enter circulation. This scarcity can drive up the value of the cryptocurrency, as demand outstrips supply.

In conclusion, the future prices of cryptocurrencies are intricately linked to the evolving mining landscape. Factors such as mining difficulty, cost, and halving events all play a role in shaping the supply and demand dynamics of digital assets. Understanding these dynamics is crucial for investors and traders looking to navigate the volatile world of cryptocurrency markets.