Comparing Crypto Market Trends with Traditional Markets

- Understanding the volatility of cryptocurrency markets

- Analyzing the impact of global events on crypto and traditional markets

- Exploring the role of regulations in shaping market trends

- Comparing the liquidity of cryptocurrencies and traditional assets

- The influence of investor sentiment on crypto and traditional markets

- Examining the correlation between crypto and stock market movements

Understanding the volatility of cryptocurrency markets

Cryptocurrency markets are known for their high volatility, which can be both a blessing and a curse for investors. Understanding the factors that contribute to this volatility is crucial for anyone looking to navigate this space successfully. Unlike traditional markets, cryptocurrency prices can fluctuate dramatically in a short period of time, making them a risky but potentially rewarding investment.

One of the main drivers of volatility in cryptocurrency markets is market sentiment. News, social media trends, and regulatory developments can all have a significant impact on the price of digital assets. This means that prices can be influenced by factors that are not directly related to the fundamentals of a particular cryptocurrency.

Another factor that contributes to the volatility of cryptocurrency markets is the relatively small market size compared to traditional markets. This means that large buy or sell orders can have a disproportionate impact on prices, leading to sharp price movements. Additionally, the lack of regulation in the cryptocurrency space can also contribute to volatility, as investors may be more prone to panic selling or buying in response to market events.

Overall, understanding the volatility of cryptocurrency markets requires a nuanced approach that takes into account both market sentiment and market structure. By staying informed about the latest developments in the cryptocurrency space and being prepared for sudden price swings, investors can better navigate this exciting but unpredictable market.

Analyzing the impact of global events on crypto and traditional markets

When it comes to analyzing the impact of global events on crypto and traditional markets, it is essential to consider how different factors can influence both sectors. Global events such as economic crises, political instability, and natural disasters can have a significant effect on market trends.

In the crypto market, these events can lead to increased volatility as investors react to uncertainty by buying or selling digital assets. On the other hand, traditional markets may experience fluctuations in stock prices, currency values, and commodity prices in response to global events.

It is crucial for investors to stay informed about global events and their potential impact on both crypto and traditional markets. By understanding how these events can influence market trends, investors can make more informed decisions about their investment strategies.

Exploring the role of regulations in shaping market trends

Regulations play a crucial role in shaping market trends, including in the realm of cryptocurrencies. The impact of regulations on the crypto market cannot be understated, as they can influence investor sentiment, market liquidity, and overall market stability.

When comparing crypto market trends with traditional markets, it is important to consider how regulations in each market can either hinder or facilitate growth. In the crypto market, regulations can vary significantly from country to country, leading to a fragmented regulatory landscape that can create uncertainty for investors.

In traditional markets, regulations are typically more standardized and well-established, providing a sense of stability and predictability for investors. However, this can also lead to a lack of innovation and flexibility in adapting to new market trends.

Overall, regulations play a critical role in shaping market trends in both the crypto and traditional markets. Finding the right balance between regulation and innovation is key to ensuring sustainable growth and stability in the ever-evolving financial landscape.

Comparing the liquidity of cryptocurrencies and traditional assets

When comparing the liquidity of cryptocurrencies and traditional assets, it is important to consider the differences in how quickly and easily these assets can be bought or sold without significantly impacting their price. Cryptocurrencies, such as Bitcoin and Ethereum, are known for their high liquidity due to the 24/7 nature of the crypto market and the ability to trade these assets on various exchanges around the world.

On the other hand, traditional assets like stocks and bonds may have lower liquidity as they are typically traded during specific market hours and on centralized exchanges. This can lead to wider spreads between buy and sell prices, making it more challenging to quickly execute trades without affecting the asset’s price.

Overall, cryptocurrencies tend to have higher liquidity compared to traditional assets, making them a popular choice for traders looking to enter and exit positions quickly. However, it is important to note that the volatility of the crypto market can also impact liquidity, as sudden price fluctuations may result in slippage when executing trades.

The influence of investor sentiment on crypto and traditional markets

Investor sentiment plays a crucial role in influencing both the crypto and traditional markets. The emotions and attitudes of investors towards a particular asset can have a significant impact on its price movements. In the crypto market, investor sentiment can be highly volatile, leading to rapid price fluctuations. On the other hand, traditional markets tend to be more stable, but they are still susceptible to shifts in investor sentiment.

In the crypto market, investor sentiment can be influenced by factors such as regulatory developments, technological advancements, and market speculation. Positive sentiment can drive up prices as investors become more optimistic about the future of a particular cryptocurrency. Conversely, negative sentiment can lead to sell-offs and price declines as investors lose confidence in the asset.

Similarly, in traditional markets, investor sentiment can be influenced by economic indicators, geopolitical events, and corporate earnings reports. Positive sentiment can lead to bullish market conditions, with investors feeling confident about the overall health of the economy. Conversely, negative sentiment can result in bearish market conditions, with investors becoming more cautious and risk-averse.

Overall, investor sentiment plays a crucial role in shaping market trends in both the crypto and traditional markets. By understanding and analyzing investor sentiment, traders and investors can make more informed decisions about when to buy or sell assets. It is essential to keep a close eye on market sentiment indicators to stay ahead of market trends and capitalize on potential opportunities.

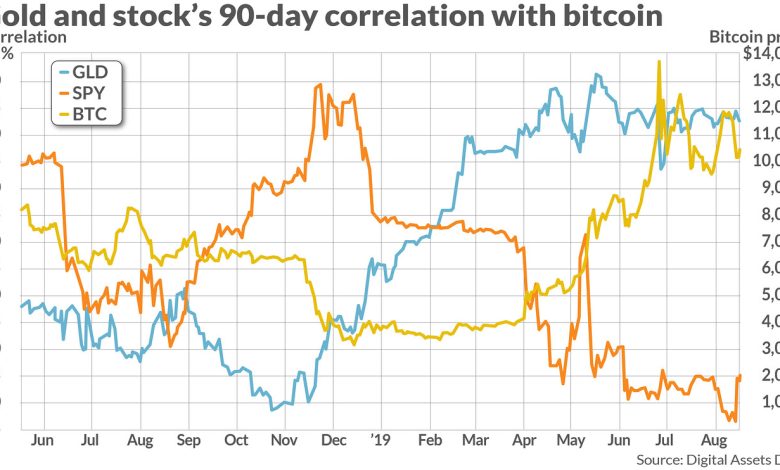

Examining the correlation between crypto and stock market movements

Examining the relationship between cryptocurrency and traditional stock market movements can provide valuable insights into the overall financial landscape. While both markets are influenced by various factors such as economic indicators, geopolitical events, and investor sentiment, there is a growing interest in understanding how they interact with each other.

One way to analyze this correlation is by looking at the price movements of major cryptocurrencies like Bitcoin, Ethereum, and Litecoin alongside key stock market indices such as the S&P 500, Dow Jones Industrial Average, and NASDAQ. By comparing the trends and patterns in these markets, we can identify potential correlations or divergences that may impact investment decisions.

Historically, there have been instances where cryptocurrency prices have mirrored stock market movements, especially during times of market volatility or economic uncertainty. This suggests that investors may view cryptocurrencies as alternative assets or safe havens during turbulent times in traditional markets.

On the other hand, there are also periods when cryptocurrencies and stocks move in opposite directions, indicating that they may serve different purposes in investors’ portfolios. Understanding these dynamics can help investors diversify their holdings and manage risk more effectively.